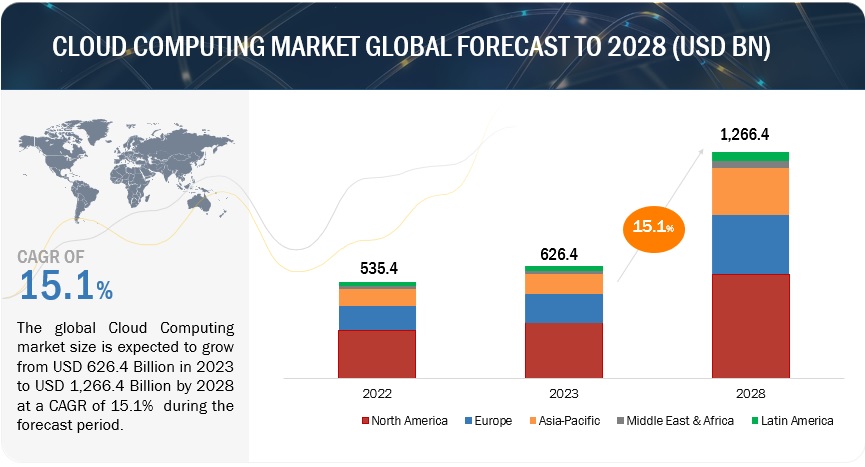

[345 Pages Report] The global cloud computing market is expected to grow from USD 626.4 billion in 2023 to USD 1,266.4 billion by 2028 at a CAGR of 15.1% during the forecast period.

The growth of the cloud computing market is the growing demand of the retail & consumer goods and healthcare & life sciences industries. It has witnessed the fastest growth owing to the increasing adoption of AI, ML, Big Data, edge computing, and 5G technologies. The key reasons for adopting these technologies are that cloud computing can support SaaS, PaaS, and IaaS service models.

Cloud computing has become an indispensable part of modern business operations, offering a wide range of benefits driving its rapid adoption. The versatility of cloud computing has led to its adoption across various industries and diverse use cases. Cloud storage services like Amazon S3, Microsoft Azure Blob Storage, and Google Cloud Storage provide scalable and secure storage for data of all types, including documents, images, videos, and files; this eliminates the need for businesses to invest in and maintain on-premises storage infrastructure. PaaS provides developers with a cloud-based platform for building, deploying, and managing applications; this eliminates the need for businesses to invest in and maintain development infrastructure. These are driving factors of the cloud computing market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Businesses aim to expand quickly and capture a significant market share. Achieving this goal entails streamlining operations by ensuring data is readily available at every touchpoint. Cloud computing services facilitate business functionalities by providing access to information across all devices anytime and from anywhere. As businesses evolve to meet customers’ needs, the demand for cloud computing services is growing, and their reliability is improving. During the first quarter of 2020, cloud spending rose 37% to USD 29 billion. The increasing need for scalable, secure, dependable, and affordable resources off-premises is driving the demand for cloud computing services. Despite the expected economic slowdown due to the pandemic, cloud spending increased by 19% in 2020, even though IT spending will decline by 8%. According to recent data, corporate spending on cloud computing is growing at double-digit rates as chief information officers and other tech leaders choose cutting-edge features such as artificial intelligence that are more expensive than standard business apps. Due to the current macroeconomic conditions, cloud leaders are increasingly using cloud-based services (42%), planning to migrate from legacy software to cloud-based tools (33%), and migrating on-premises workloads to the cloud (32%).

Organizations require staff with technical skills and knowledge to implement, process, analyze, and secure cloud solutions. However, there is a severe scarcity of technical skills among IT workers, particularly in cloud computing. This lack of expertise is causing companies to miss out on the benefits of the cloud and emerging technologies, ultimately leading to a loss of market share and revenue. Companies struggle to find suitable candidates due to challenges, including rapid hiring processes, high wages for experienced cloud workers, and difficulty finding individuals who align with the organization’s culture. If the shortage of cloud workers continues, the company’s growth engines could sputter. Despite 80% of IT leaders recognizing that the lack of skilled workers prevents companies from expanding their modern software engineering and cloud environments, over 90% plan to achieve this goal.

The technological landscape evolves with innovations added every day. Two of the closely related future internet technologies are IoT and cloud computing. IoT provides a foundation for cloud computing to succeed. IoT devices produce data that must be collected and processed locally or remotely on a server. In many IoT applications, remote data hosting and analytics are more practical and cost-effective solutions. As IoT and cloud computing continue to expand, there is also a growing interest in edge computing. Edge computing can help reduce the demand for cloud storage by pre-filtering data and sending only some of it to distant servers.

Moreover, edge computing has enormous promise for real-time data analytics. In the future, it is likely to work in conjunction with IoT devices and cloud computing, providing an even better framework for the constantly growing data streams from massive IoT applications. However, moving all data processing and storage back to the edge is impractical for most businesses.

Lean IT teams are facing new challenges in addressing their current difficulties. Businesses have traditionally focused on cost control, efficiency improvement, and process optimization. However, the pandemic has forced them to prioritize deployments, leading to a rush towards public cloud solutions without adequate due diligence; this has resulted in increased complexity, higher costs, and less flexibility, with little focus on achieving strategic business goals. According to a recent study, 87% of respondents agree that managing mixed-cloud infrastructures is essential for multi-cloud success. As multi-cloud deployments become more common, organizations face various challenges in managing cloud resources. Cloud computing operates at multiple levels, each with its best practices and deployment rules, making it difficult to use in multi-cloud scenarios. The complexity of managing cloud resources increases with each additional cloud environment used. The management burden also increases with the number of public cloud vendors used, as no industry standards exist. Therefore, it is crucial to review the security measures of each vendor and understand the breadth of their security measures before signing up for multi-cloud services.

Hybrid cloud in cloud computing refers to an IT architecture incorporating some degree of workload portability, orchestration, and management across two or more environments, including on-premises data centers, private clouds, and public clouds. The hybrid cloud model allows organizations to take advantage of the benefits of both private and public clouds, providing greater flexibility, scalability, and optimization of resources. A hybrid cloud will enable organizations to move applications and workloads between private and public clouds based on specific needs. This flexibility is valuable for managing varying demands and optimizing costs. A hybrid cloud provides the capability to have redundant and backup systems across different environments. In case of a failure or disaster in one location, workloads can be shifted to another environment, ensuring business continuity. A hybrid cloud allows organizations to optimize costs by choosing the most cost-effective platform for each workload. It also enables a pay-as-you-go model for resources consumed from public clouds.

Payment gateways, online fund transfers, digital wallets, and unified customers play a significant role in the BFSI industry, facilitating the transition to cloud deployment. BFSI companies have started using Infinity Distribution Services, a suite of cloud-based banking distribution services launched by Switzerland-based company Temenos. The company leverages AI to modernize its legacy systems into digital platforms. These platforms would enable banks to offer digital onboarding services, fund authorization, marketing, and other services that banks of any size can deploy in any pandemic. Additionally, MACIF Group, a French mutual insurance provider, has deployed Microsoft’s G Suite for over 8,000 employees to ensure business continuity. This deployment has allowed employees to shift from in-person to more than 1,300 Google Meet video meetings daily. Regulatory Compliance and Reporting- Cloud-based compliance solutions help banks manage and maintain compliance with complex and ever-changing regulatory requirements. These solutions automate compliance tasks, provide real-time reporting, and ensure adherence to data privacy regulations. Mobile Payments and Transfers- Cloud-based solutions facilitate secure and convenient mobile payments, money transfers, and bill payments, enabling customers to manage their finances seamlessly from their smartphones or tablets.

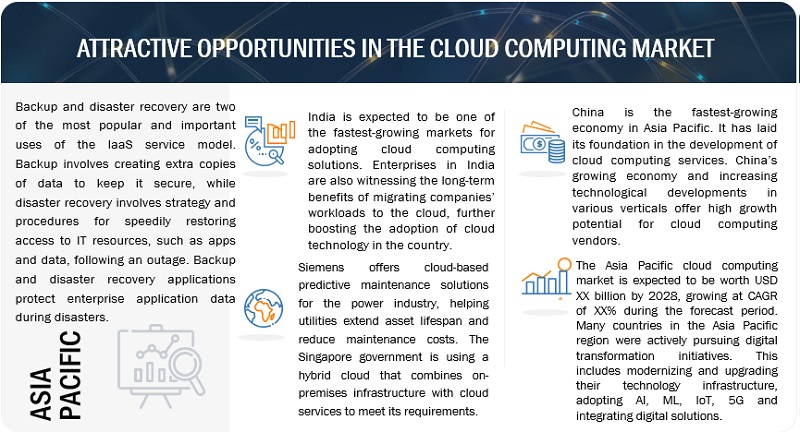

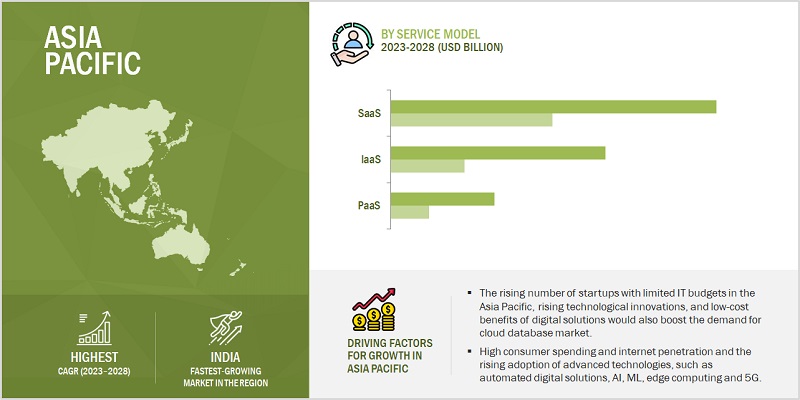

The adoption of advanced technologies, such as IoT and AI, edge computing, and 5G across verticals will drive the growth of the cloud computing market in the Asia Pacific. The increasing investments from private sectors, robust government support, and availability of a vast population drive the growth of new and emerging technologies in the Asia Pacific. Many countries in the Asia-Pacific region are embracing AI and machine learning technologies across industries, including finance, healthcare, retail, and manufacturing. Japan is one of the most advanced countries in terms of ICT development. It has always been a frontrunner in adopting advanced technologies like IoT, LTE, SDN, and AI. With the expansion in public cloud technologies, many enterprises in Japan want to switch their core applications to the cloud. With migration toward the cloud over the next five years, IaaS and PaaS are likely to surpass the growth of the SaaS model, which would increase the adoption rate of cloud computing in the region. According to secondary data, the country has been ranked second on the Global Cloud Computing Scoreboard. Therefore, Japanese companies are the main reason for promoting R&D investments for technological advancements. The expansion of the cloud computing market in Australia is due to the prevalence of numerous channel partners in the region, including VAR distributors, and their ongoing efforts to assist customers in switching to the cloud. The country presents attractive opportunities for cloud-based technologies due to the availability of advanced and reliable cloud infrastructure. Most MSPs in Australia are helping enterprises navigate various cloud options and migrate the existing workloads to multiple cloud environments, leading to the growing adoption of the multi-cloud strategy in Australia.

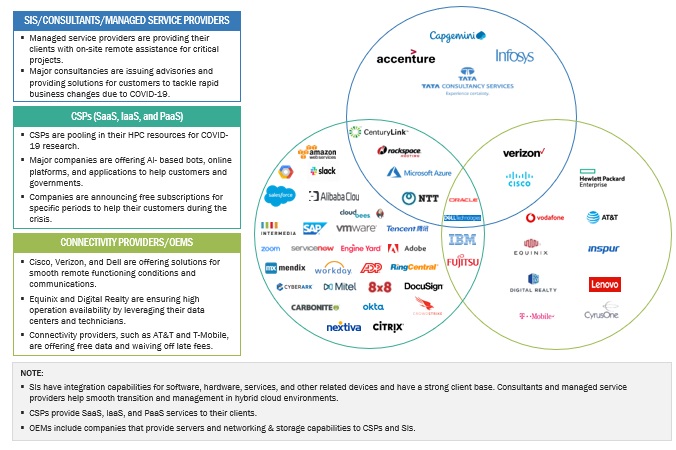

AWS (US), Microsoft (US), IBM (US), Google (US), Alibaba Cloud (China), SAP (Germany), Salesforce (US), Oracle (US), Adobe (US), Workday (US), Fujitsu (Japan), VMware (US), Rackspace (US), DXC (US), Tencent Cloud (China), NEC (Japan), DigitalOcean (US), Joyent (US), Skytap (US), OVH (France), Navisite (US), CenturyLink (US), Infor (US), Sage (UK), Intuit (US), OpenText (Canada), Cisco (US), Box (US), Zoho (US), Citrix (US), Epicor (US), Upland Software (US), ServiceNow (US), IFS (Sweden), App Maisters (US), Zymr (US), JDV Technologies (India), Tudip Technologies (India), Visartech (US), Cloudflex (Nigeria), Cloudways (Malta), Vultr (US), and pCloud (Switzerland) are the key players in the cloud computing market.